February 14, 2019

Moreton Resources – the company aiming to develop a coal mine on the outskirts of Kingaroy – has been quizzed by the ASX about its negative cash flows.

On January 17, Moreton released its quarterly cashflow report which showed a negative cash flow from operating activities of $4.7 million in the six months to December 31, 2018.

The report also noted that Moreton had short-term loans of $500,000 repayable on March 29, 2019, and $2.7 million repayable on April 1, 2019.

A total of $7.05 million was available as debentures secured over the assets of the company – $3 million (a two-year term to May 26, 2019) and $4.05 million (to June 2, 2019).

On February 4, the ASX wrote to Moreton asking:

- Does MRV expect that it will continue to have negative operating cash flows for the time and, if not, why not?

- Has MRV taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

- Does MRV expect to be able to continue its operations and to meet its business objectives, and if so, on what basis?

On February 6, Moreton notified the ASX that effective immediately Company Secretary and Chief Financial Officer John Haley had resigned as a Director.

Mr Haley, who was on a short-term contract, had been due to remain as a Director until the end of February.

On February 11, Moreton executive chairman Jason Elks responded to the ASX questions, saying he believed his answers would put at ease any queries that Moreton may not be complying with listing rules.

Mr Elks said Moreton would “seek to enter cash generation by way of silver sales from its Granite Belt project in the month of February 2019”.

“Furthermore, the company has since, upon February 8, 2019, further updated the market that the company expects to be in silver production in February and steady state operations are expected in April 2019, allowing for forecasts and projections in the April quarter of 2019.

“Whilst the company cannot specifically state with certainty the amount of revenue it expects in the January 2019 quarter, it does believe the silver sales will go toward alleviating any shortfall for the quarter, along with a debt restructure as outlined below.”

Mr Elks said Moreton was also well advanced in renegotiating funding.

“This process has moved to the exchange of draft, binding terms already undertaken. It is highly likely this transaction will be completed in the coming days and again highly likely to alleviate any or all immediate cash flow and operating cost concerns.”

Mr Elks said Moreton was in full compliance with listing Rule 3.1 and the market was “fully aware of all matters pertaining to operational outcomes and funding requirements”.

Also on February 11, Mr Elks announced the appointment of two new Directors with mining industry experience to Moreton: Gary Harradine and Brent Van Staden.

Mr Elks said he would continue to run the day-to-day company affairs as Executive Chairman and lead the Board while Moreton sought a new chair in coming months.

Moreton told the ASX on February 8 its next update on the Granite Belt project “will likely pertain to the successful commissioning and subsequent achievement of silver production”.

* * *

Kingaroy Concerned Citizens Group, the landholder group opposed to the Kingaroy coal mine, is seeking an explanation from the State Government as to why Moreton Resources’ mineral development licence (MDL 385) – which covers the area of the former Cougar Energy UCG site – has been renewed.

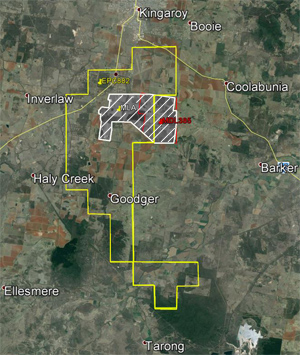

MDL 385 would form part of the footprint for Moreton’s proposed Kingaroy coal mine. The licence was due to expire in February but the KCCG was notified in January that it would be renewed.

Moreton currently has a Mining Lease Application (MLA 700015) which includes MDL 385 and an area to its west.

The KCCG had called on the State Government to cancel Moreton Resources’ mineral development licence when it came up for renewal.

KCCG spokesman John Dalton said the three-year approval for MDL 385 was effectively giving Moreton another three years to lodge an Environmental Impact Statement with the State Government.

Prior to the approval, the KCCG had asked Mines Minister Dr Anthony Lynham to invoke the “public interest” provisions of the Mineral Resource Act to refuse the application based on its proximity to the town area, being on excellent farmland and also in the town water catchment area.

Mr Dalton said he had been trying to arrange a meeting with Dr Lynham on the mine site since September 2018 so the Minister could understand the reasons why the mine proposal was so unpopular locally and worthy of a public interest refusal.

“We have no idea why this MDL was given another three-year approval,” Mr Dalton said.

“During the first five-year period of the lease, the company had the unsuccessful Cougar Energy UCG trial, and in the next five-year period, the company failed to submit an EIS to government in the required time.

“This MDL has produced 10 years of heartache and uncertainty, and now the government thinks we should endure another three years.

“We don’t know how criteria such as technical capability and financial capability were applied to this application and its approval, and we are disappointed that we could not express our views to the Minister about this recalcitrant proposal in our district.”

The KCCG has written to Dr Lynham to seek a full explanation about the renewal.

Related articles:

- Let Moreton’s Licence Expire: KCCG

- Moreton Weighs Up Sale Of Mine

- Elks Sets Date To Quit As CEO

- Moreton Turns $10,000 Into $13.3m

- KCCG Unveils Coal Rail Maps

- Moreton Delays Release Of EIS

- Protest Group Targets Rail Crossings

- Moreton Says ‘Selective Mining’ Would Extract Cleaner Coal

- Coal Mine Decision ‘By Next Christmas’

- SB Coal Project ‘Well-Advanced’

- Moreton Outlines Plan To Pay Off Tax Debt

- Moreton To Secure Cash Flow

- Taabinga Declared A Coal-Free Community

- Moreton Aims For Coal In 2019

- Moreton ‘Praises’ KCCG Art Project

- Mine Fight Comes Alive With Art

- Moreton Gives Council Coal Mine Update

- Photo Shoot Captures Coal Mine Site

- KCCG Says Moreton Statement Misleading

- Moreton Aims For Rail Corridor

- Moreton Presses On With Mine Plan

- Moreton To Push Ahead With EIS

- Moreton Tax Bill Still In Limbo

- KCCG To Ramp Up Campaign

- Elks’ Role Cut Back Again

- Moreton Appoints Project Manager

- Moreton Starts Mine Approval Process

- KCCG To Make Mine Submission

- Moreton Applies For Mining Licence

- Greens Back Kingaroy Mine Protest

- KCCG Calls For Coal Permit Buyback

- Elks To Resign As Moreton CEO

- Another Step For Moreton Resources

- KCCG Demands Pre-Mining Health Tests

- Crowd Votes Down Mine … Again

- Moreton Faces $8m Tax Bill

- KCCG To Hold Second Anti-Mine Forum

- KCCG Plans Second Forum

- Nannas Take To The Highway

- Kingaroy Coal Mine To Require Federal Approval

- Moreton Looks For Silver Lining

- Between A Rock And Taabinga Village

- Moreton Re-issues Update

- Market Awaits Moreton News

- Moreton Predicts 400-600 Jobs At Mine

- Airport Blocks Cut From Coal Permit

- KCCG Rejects Phone Poll

- Phone Poll Backs Mine: Moreton

- Moreton Takes Mining Plan Out To The People

- KCCG Will Speak To Council

- Nannas Knit Against Mine

- KCCG Meets With State Government

- Coal Mine Fight Spreads

- Moreton Resources Unveils Mine Partner

- Meetings To Discuss Mine

- Moreton Plans To Start Seeking Permits

- Moreton’s Coal ‘Too Expensive’

- Kingaroy Coal Mine? No Way!

- Public Meeting To Discuss Coal Mine

- Stanwell Still Says ‘No’

- Moreton Releases Mine Study Results

- Moreton Resources Eyes Rail Link

- Moreton Buys More Resources

- Mining CEO Talks To Council

- KCCG Sees No Future For Mine

- Green Light For ‘Next Step’

- Moreton Board To Consider ‘Next Step’

- Moreton Resources Splits Off South Burnett Holdings

- Moreton Resources Extends Licence

- Controversial UCG Plant Vanishes

- UCG Plant Starts To Disappear

- Moreton To Begin Mine Concept Study

- Moreton Responds To MP’s Comments

- Moreton Aims To Press On

- Stanwell ‘Rejecting Billions In Savings’

- Stanwell Rules Out Moreton Coal

- ‘Enough Coal For 30-Plus Years’

- Concept Study Next Step For Proposed Coal Mine

- Moreton Triples Coal Estimates

- Coal Mine Review Delayed To July