|

October 7, 2014

The State Government has ruled out selling government-owned corporations such as Stanwell and Ergon Energy, opting instead to lease the assets.

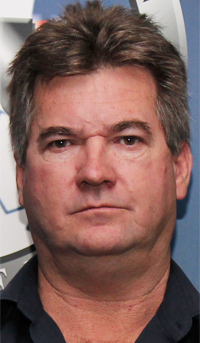

Premier Campbell Newman said today the State Government had “listened to Queenslanders and responded to their feedback about retaining their stake in public assets”.

“In response, the government has decided not to sell assets,” Mr Newman said.

“We have had an in-depth discussion about these issues in the Cabinet and the party room today and we have agreed to a plan to reduce debt and build infrastructure that will potentially create up to 25,000 jobs.”

Treasurer Tim Nicholls said Queenslanders had made it clear they wanted the State Government to deal with the $80 billion debt problem but they also wanted the government to retain control over the assets.

“Leasing some assets is the strongest and smartest choice because it will generate the funds needed to bring the State’s debt back under control, while ensuring Queenslanders always retain ownership,” Mr Nicholls said.

“Under our plan the government would write strict lease conditions to ensure Queenslanders’ interests were upheld.

“The leases would be for 50 years with an option to extend for a further 49 years and would include conditions around the appropriate use of land and the assets, safety requirements and service levels.”

Mr Newman said the State Government would also continue payments to the electricity companies to keep prices for regional Queenslanders in line with prices in the south-east.

“Importantly, this is a plan for Queensland’s future,” he said.

“By reducing our debt we can free up funds to create jobs and build the infrastructure our growing State needs.”

The State Government now proposes to offer for lease:

- The Ports of Gladstone and Townsville (with the Mt Isa Rail line)

- The commercial water pipelines of SunWater

- Electricity generators Stanwell Corporation and CS Energy Ltd

- Electricity transmission and distribution companies Energex, Ergon and Powerlink

- A range of “non-core business activities” currently run by the corporations

Mr Nicholls said the State Government had listened to advice of independent experts, Queensland’s Treasury and Queensland Treasury Corporation to ensure the Strong Choices final plan would also deliver the best financial outcome for Queenslanders.

He said the plan was expected to yield $37 billion.

Those funds would be allocated as follows:

- $25 billion to reduce State debt from $80 billion to $55 billion, with annual interest payments reduced from $4 billion to $2.7 billion – a saving of $1.3 billion

- $8.6 billion to establish the Strong Choices Future Investment Program which will create 11 separate funds, each of which is dedicated to supporting infrastructure considered vital to economic growth, jobs and vibrancy of regional communities

- $3.4 billion in a dedicated fund to relieve cost of living pressure for Queenslanders

“None of these proposals will be implemented until the government has received a mandate for this methodical and disciplined plan at the next State election,” Mr Nichols said.