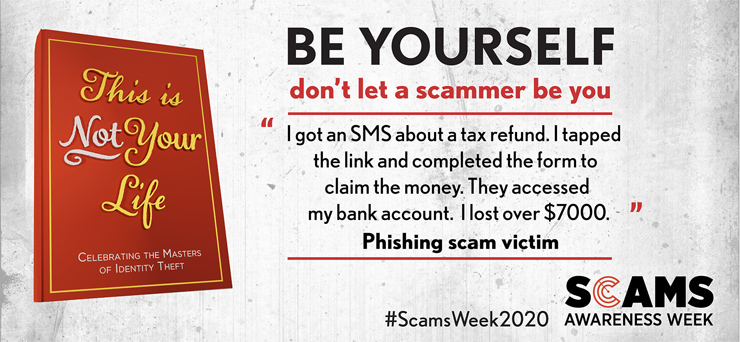

“Be yourself – don’t let a scammer be you!” This is the message the Australian Competition and Consumer Commission’s “Scamwatch” is emphasising during National Scams Awareness Week (August 17-21).

So far this year there has been an amazing 24,000 reports to Scamwatch of stolen personal information – up 55 per cent from last year.

Financial losses across all scams has reached $91 million.

And who knows how many other Australians have been scammed but feel too sheepish to report they’ve been duped?

We all think “they won’t catch me because I am too smart for that” but the reality is people from all walks of life are being scammed, not because they aren’t smart but because many scams are very realistic and aren’t always easy to identify.

The ACCC said people aged 25-34 reported losing personal information more than any other age group.

To help consumers be alert to scams, the ACCC has launched a five-episode podcast series,”This is Not Your Life” (see link below), to provide tips on how to protect personal and financial details.

“During the COVID-19 pandemic, with more people working and socialising online, we have unfortunately seen a sharp increase in scammers seeking personal information,” ACCC Deputy Chair Delia Rickard said.

“Personal information, such as bank and superannuation details or passwords, are extremely valuable and scammers will try to steal them for their own financial gain. Our increased use of technology has created more opportunities for them to do so.”

“Scammers will also try and steal a range of other documents, or the numbers associated with them, including passports, driver licences, credit cards, tax statements, utility bills or Medicare cards, so that they can impersonate you.”

Phishing scams, the most common form of scam, are up by 44 per cent compared with the same time last year.

Scammers often pretend to be from government departments and businesses, such as the ATO, myGov, Telstra or the NBN, to gain bank account details and other information.

Once a scammer has that information, they can then use it to access individuals’ bank accounts or superannuation, take out loans under their names and impersonate them on social media to try to get money from family and friends.

“Never give your personal or financial information to anyone you don’t know or trust via email, text, social media or over the phone,” Ms Rickard said.

“If you do have your identity stolen, it can take years to recover and people can end up losing more than money. Not only time in trying to undo the damage done financially, but it can also impact greatly on your mental health.”

If you suspect you are a victm of identity theft, contact IDCARE on 1300-432-273. IDCARE is a free government-funded service which will work to develop a specific response plan to your situation.

If you have been the victim of a scam, contact your bank as soon as possible and contact the platform on which you were scammed to inform them of the circumstances.

More information on scams is available on the Scamwatch website, including how to make a report and where to get help.

- External link: This Is Not Your Life podcast