by Dafyd Martindale

At the South Burnett Regional Council’s May meeting, Councillors voted unanimously to press the Federal Government for a fairer slice of the taxation pie.

The South Burnett has joined a national campaign led by the Australian Local Government Association and the Local Government Association of Queensland which has has two simple demands:

- It wants the Federal Government to abandon a plan to freeze indexation of annual grants for the next three years which would (in the South Burnett’s case) strip a further $2.8 million out of the region’s income, and …

- It wants the Federal Government to return a fairer slice of the nation’s revenue to local councils than the slim 2 per cent they receive today.

We think they have a very good case.

At the moment, the Federal Government swallows about 84 per cent of the total tax cake and State Governments consume another 14 per cent.

What little is left goes to councils.

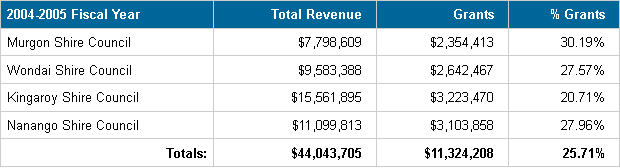

Ten years ago the average amount of grants received by the four old Councils that were merged to form the South Burnett Regional Council contributed between 20-30 per cent of their total annual income (see table below).

Today, though, the South Burnett Regional Council receives just 13.1 per cent of its annual income from grants.

Or in other words, over the last decade the amount of Federal grants given to our region each year has almost halved.

The consequences of this are obvious to everyone.

Rates across the South Burnett have risen sharply since 2008, only reaching a plateau two years ago when the new amalgamated Shire finally achieved some measure of financial stability.

This has not only hit ratepayers squarely in the pocket but renters, too.

And it was the loss of yet more Federal grants in late 2012 that directly led to the introduction of the $200 per annum Road Levy in our region.

This unexpected – and still unexplained – loss of Federal grant money meant the Council either had to close down community services (such as libraries and pools) or let our roads disintegrate or – as it chose to do – get an extra contribution from everyone to keep the ship of state afloat.

And these, of course, are just our region’s petty troubles.

Rates everywhere else in Queensland have also risen sharply since the 2008 amalgamations.

And tellingly, the same has happened in other States where no amalgamations have taken place.

Some of this, of course, is due to natural value increases.

Money invested at 7 per cent will double roughly every 10 years.

So a $100 rates bill in 2004 could be expected to be $150-$160 in 2014 if annual rate rises had been held to CPI. And this could have occurred if the level of Federal support had stayed the same.

But the root cause of the rises we’ve all paid for, in one way or another, is the steady withdrawal of Federal Government funding support from councils over the last decade.

Which amounts to nothing more – and nothing less – than taxation by stealth.

- Related article: Council Joins Grant Freeze Fight

Data Sources (PDFs):